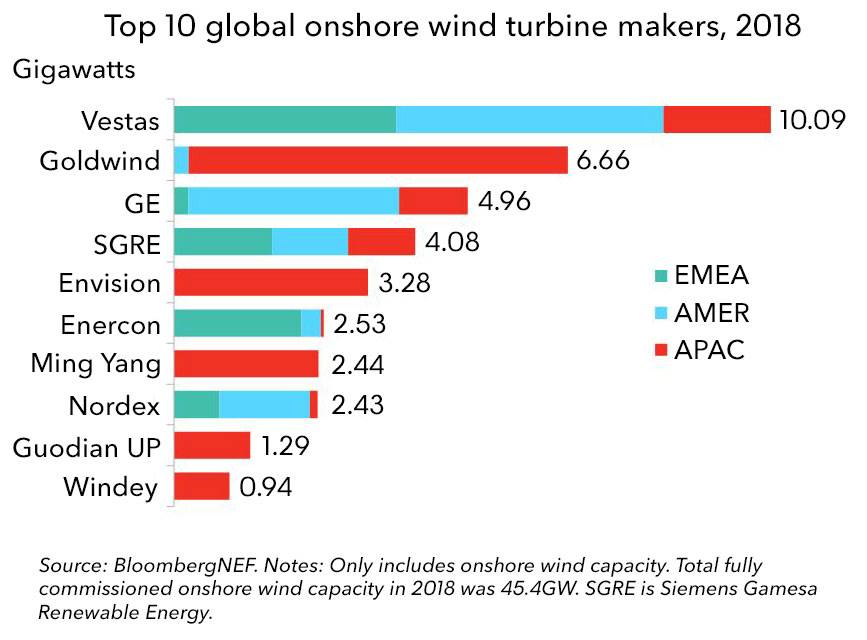

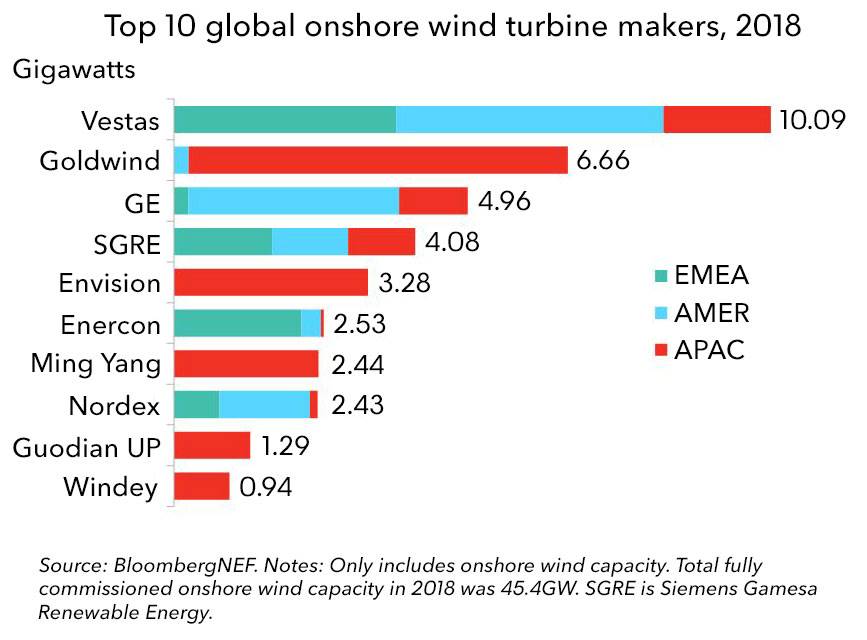

In 2018, commissioned by developers worldwide has built more than 45 gigawatts of onshore wind turbines, and in the same period last year to 47 GW. The world's top four fan manufacturers occupy the deployment of more than half of the scale, or 57%. They are Denmark's Vestas, China's Goldwind Technology, America's GE Renewable Energy and Spain's Siemens Gamesa.

Vestas' lead in the industry continues, with 10.1GW of its onshore turbines commissioned in 2018, accounting for 22% of the global market share, compared with 16% in 2017, according to the latest data from Bloomberg New Energy Finance (BNEF).

China's Goldwind moved up from third to second place, helped by the country's strong performance. The Chinese market had 19.3 gigawatts of wind turbines deployed throughout the year, with Goldwind accounting for nearly a third, or about 6.7 gigawatts. However, the company's global presence remains limited, with only 5 per cent of production outside China. General Electric is third with 5 gigawatts, and six out of every 10 GE turbines are in service in the United States.

"In terms of offshore wind, this has been a record year for China and we are going to see more growth," Harries continued. "Of the 4.3 gigawatts of offshore wind produced globally, 1.7 gigawatts are in China. In Europe, it is a fierce battle between Siemens Gamesa and Mitsubishi Vestas Offshore Wind. Ge has a number of projects in France and we also expect to see orders for their new 12MW platform."

Overall,

onshore wind installations in 2018 totaled 11.7 gigawatts in the Americas, 8.5

gigawatts in Europe, 1 gigawatts in Africa and the Middle East, and 24.2

gigawatts in Asia.

David Hostert, head of wind energy research at BNEF, said: "Last year was a bit of a mess in terms of onshore wind installations globally, with only 45.4 gigawatts coming on stream. In addition, 4.3 gigawatts of offshore wind was added, slightly less than in 2017. Now is the time for manufacturers to boom over the next two years: we forecast demand for onshore capacity of about 60 gigawatts in 2019 and 2020."

2018年,开发商在全球范围内委托建造了超过45吉瓦的陆上风力涡轮机,而去年同期为47吉瓦。全球四大风机制造商占据了部署规模的一半以上,即57%,它们分别是丹麦维斯塔斯,中国金风科技,美国的通用电气可再生能源以及西班牙的西门子歌美飒。

彭博社新能源财经(BNEF)的最新数据显示,维斯塔斯在该行业中的领先优势继续保持,其2018年陆上涡轮机的10.1GW投入使用,占全球市场份额为22%,而2017年为16%。

中国的金风科技从第三位上升到第二位,这得益于中国的强劲表现。中国市场全年部署风机19.3吉瓦,金风科技占据近三分之一,约6.7吉瓦。然而,该公司的全球业务仍然有限,只有5%在中国境外投产。通用电气以5吉瓦排名第三,美国每10台GE涡轮机中就有6台在美国投入使用。

“在海上风电方面,这对中国来说是创纪录的一年,我们将看到更多的增长,”Harries继续道,“全球投产4.3吉瓦的海上风电中,有1.7吉瓦位于中国。在欧洲,这是西门子歌美飒和三菱维斯塔斯海上风电公司之间的激烈竞争。通用电气在法国有一些项目,我们也期望看到他们的新12MW平台的订单。”

总体而言,2018年的陆上风电装机总量在美洲为11.7吉瓦,欧洲为8.5吉瓦,非洲和中东为1吉瓦,而亚洲为24.2吉瓦。

打造绿色低碳街区,奏响幸福美好生活最强音

10-18 · 来源:湖北省武汉市江汉区北湖街道环保社区 · 作者:湖北省武汉市江汉区北湖街道环保社区

“碳惠冰城”:东北首个市级平台的“双碳”实践与冰城示范

10-15 · 来源:哈尔滨产权交易所有限责任公司 · 作者:哈尔滨产权交易所有限责任公司

亚洲气候治理新篇章:中国公益代表团参访曼谷气候周,探索跨区域合作新路径

10-10 · 来源:公益时报 · 作者:公益时报